| Topic: How is that stimulus working out? | |

|---|---|

|

Here is some great news about the economy.. I'm sure it doesn't matter because we have the smartest man in the world running the show and his brilliant economic advisers working tirelessly on ways to continue spending money they don't have.. But hey... let's keep talking up the mosque controversy because it's far more important than this..

Wall Street tumbled after disappointing US jobless data and a surprise contraction in factory activity - a key gauge of the economy - heightened worries over the sustainability of the recovery. The Dow Jones was trading down 1.5pc at 10255 at lunchtime in New York. The broader S&P 500 and the technology rich Nasdaq both fell around 1.7pc. European markets were also hit as the data reinforced fears about the scale of the US economic slowdown and a possible fall back into recession. London's FTSE 100 index of leading British shares closed down 1.7pc to 5211, with Germany's DAX and the CAC-40 in France losing 1.8pc and 2pc respectively. "This double-dip prospect for the US keeps coming up so any signs of concern here could again precipitate another wave of selling," said Will Hedden, sales trader at IG Index. Sentiment was knocked by figures showing the number of American filing for jobless benefits jumped unexpectedly to the psychologically sensitive 500,000 level last week, the highest in nine months. Economists had expected 475,000. The Federal Reserve Bank of Philadelphia’s general economic index fell to minus 7.7 from 5.1 in July, the lowest level since August 2009. Readings above zero signal growth in the regional gauge, which covers eastern Pennsylvania, southern New Jersey and Delaware. Ira Jersey, Interest rate strategist at Credit Suisse in New York, said: "The Philly Fed report is concerning because it had been showing the economy was doing okay. But now it is showing the new orders and employment components are in negative territory. "That's bad news for the economy and good news for the Treasuries market." Double-dip deflation fears helped push the price of the 30-year US Treasury up a point and the yield down to 3.65pc. http://www.telegraph.co.uk/finance/markets/7954285/Wall-Street-tumbles-spooked-by-shock-jobless-manufacturing-data.html |

|

|

|

|

|

Yeah - and there's still $400+BN of the 'stimulus' that's UNSPENT ... it'll stay 'unspent' right up to the weeks before the election - that's when they make clear that the REAL purpose of using TAXPAYER's money for 'stimulus' was to 'stimulate' the bank accounts of DemoComs with the 'stimulus slush fund' money ... don't blink, or you'll miss it ...

|

|

|

|

|

|

Most of the folks claimin' recession or double-dippin' ain't so bad are the folks who aren't affected by it.

|

|

|

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs.

Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

|

|

|

|

|

|

well... the chicago school economists that are devising the policy aren't going to change course now. they are going to continue the spending and probably at an even more alarming rate.

it's a good thing they spent an entire year on health care. and most of this year worrying about taking arizona to court. Can't let a good crisis go to waste.. A recession every other year and they could have all their little pet projects passed into law.. |

|

|

|

|

|

The Fed gave the stimulus money to the States.

If they pissed it away and didn't create any jobs, it's their fault. |

|

|

|

|

|

Unemployment extensions won't last forever.

Then, there will be a couple new layers added to the homeless sector. On the bright side. Husseins unemployment numbers will show less folks unemployed. |

|

|

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. |

|

|

|

|

|

The Fed gave the stimulus money to the States. If they pissed it away and didn't create any jobs, it's their fault. half the states are going bankrupt too... what were they supposed to do? |

|

|

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

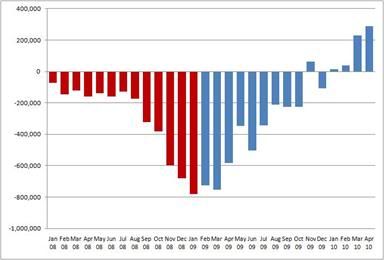

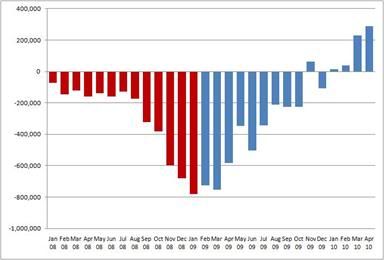

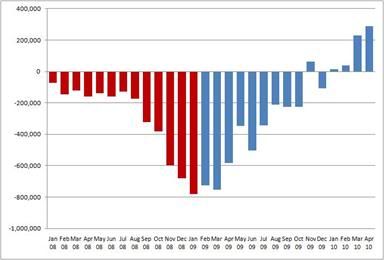

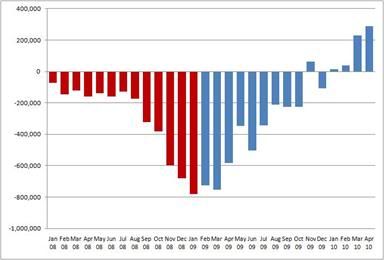

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. Riiiight, I mentioned the bailouts along with the stimulus because they are both deficit impacting. You can't get a loan to save your business if there are no banks to borrow from. The stimulus monies are working to stop the job losses and so far it's working. Slowly. Here are the results from the Dippic's economic reign of horror to now:

Wall Street reforms are also in the workings...hopefully we can avoid the financial corruptions that got us into trouble in the first place. http://en.wikipedia.org/wiki/US_Financial_Regulatory_Reform |

|

|

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. Riiiight, I mentioned the bailouts along with the stimulus because they are both deficit impacting. You can't get a loan to save your business if there are no banks to borrow from. The stimulus monies are working to stop the job losses and so far it's working. Slowly. Here are the results from the Dippic's economic reign of horror to now:

Wall Street reforms are also in the workings...hopefully we can avoid the financial corruptions that got us into trouble in the first place. http://en.wikipedia.org/wiki/US_Financial_Regulatory_Reform None of that addresses the fundamental problem. The Feds loose monetary policy after the DOTCOM bubble busting lead to a massive expansion in easy credit. It didn't help that Freddie and Fannie were making loan guarantees so banks would give mortgages to people that shouldn't have got them. Plus you had politicians pressuring banks to lower lending standards. This is a systemic problem. Until you collapse the consumption based debt driven economy, no reform or over regulation is going to change the fundamentals that brought this and the next collapse upon us. |

|

|

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. Riiiight, I mentioned the bailouts along with the stimulus because they are both deficit impacting. You can't get a loan to save your business if there are no banks to borrow from. The stimulus monies are working to stop the job losses and so far it's working. Slowly. Here are the results from the Dippic's economic reign of horror to now:

Wall Street reforms are also in the workings...hopefully we can avoid the financial corruptions that got us into trouble in the first place. http://en.wikipedia.org/wiki/US_Financial_Regulatory_Reform None of that addresses the fundamental problem. The Feds loose monetary policy after the DOTCOM bubble busting lead to a massive expansion in easy credit. It didn't help that Freddie and Fannie were making loan guarantees so banks would give mortgages to people that shouldn't have got them. Plus you had politicians pressuring banks to lower lending standards. This is a systemic problem. Until you collapse the consumption based debt driven economy, no reform or over regulation is going to change the fundamentals that brought this and the next collapse upon us. You're politcally microsizing the issue here, the FED was just ONE area in the process that led us into this mess. You are totally ignoring who the benefactors were in creating this horrible economic disaster. Big Corp. The Wall Street Reform bill, tho~ watered down like the HC Bill to appease the GOP, should be the beginning of the end of Big Corporate control of our government. Dude, got HULU? See "The Corporation" documentary. I had been screaming for years about Corporate Socialism but it's only now that people are waking up to the fact that we ARE being controlled for corporate profits over what's best for us...in ALL areas of our lives. Wall Street Reform Bill: (Wiki) "Some of the major topics it includes are creation of the Consumer Financial Protection Bureau and the Financial Stability Oversight Council, Limiting large complex financial instruments and making derivative market more transparent, many new requirements and oversight of Credit Rating Agencies, giving shareholders a say on CEO’s bonuses and many others with the main focus of strengthening economy and protecting consumer" ~~~~ Political positioning for the fall elections or are you really interested in the full story? I hope you view the documentary...it's amazing, several former CEO's testify on it...kinda long but it's a complicated issue right? It took a lot of conditions from several institutions to get us in this deep of a hole. There's no one specific smoking gun in this mess. http://www.thecorporation.com/index.cfm |

|

|

|

|

|

Unemployment extensions won't last forever. Then, there will be a couple new layers added to the homeless sector. On the bright side. Husseins unemployment numbers will show less folks unemployed. President Obama wanted to see the small business bill passed but the GOP wants to keep blocking it. When are you going to figure out that the GOP does NOT want to see the economy turn around? |

|

|

|

|

|

Unemployment extensions won't last forever. Then, there will be a couple new layers added to the homeless sector. On the bright side. Husseins unemployment numbers will show less folks unemployed. President Obama wanted to see the small business bill passed but the GOP wants to keep blocking it. When are you going to figure out that the GOP does NOT want to see the economy turn around?

|

|

|

|

|

|

Edited by

1956deluxe

on

Thu 08/19/10 05:04 PM

|

|

|

The Fed gave the stimulus money to the States. If they pissed it away and didn't create any jobs, it's their fault. half the states are going bankrupt too... what were they supposed to do? They (States) were supposed to submit a list of shovel ready projects that would help create some employment in their States. The federal government didn't make up the lists, it was up to the States. What did the idiots in your State submit? Have you ever looked into it? Here is a link http://stimuluswatch.org/2.0/performance_places/state/TX |

|

|

|

|

|

The Fed gave the stimulus money to the States. If they pissed it away and didn't create any jobs, it's their fault. half the states are going bankrupt too... what were they supposed to do? They (States) were supposed to submit a list of shovel ready projects that would help create some employment in their States. The federal government didn't make up the lists, it was up to the States. What did the idiots in your State submit? Have you ever looked into it? Here is a link http://stimuluswatch.org/2.0/performance_places/state/TX no, can't say that i have... we are a little short here in texas, but not like Michigan or Cali. the link doesn't work. |

|

|

|

|

|

The Fed gave the stimulus money to the States. If they pissed it away and didn't create any jobs, it's their fault. half the states are going bankrupt too... what were they supposed to do? They (States) were supposed to submit a list of shovel ready projects that would help create some employment in their States. The federal government didn't make up the lists, it was up to the States. What did the idiots in your State submit? Have you ever looked into it? Here is a link http://stimuluswatch.org/2.0/performance_places/state/TX no, can't say that i have... we are a little short here in texas, but not like Michigan or Cali. |

|

|

|

|

|

The Fed gave the stimulus money to the States. If they pissed it away and didn't create any jobs, it's their fault. half the states are going bankrupt too... what were they supposed to do? They (States) were supposed to submit a list of shovel ready projects that would help create some employment in their States. The federal government didn't make up the lists, it was up to the States. What did the idiots in your State submit? Have you ever looked into it? Here is a link http://stimuluswatch.org/2.0/performance_places/state/TX no, can't say that i have... we are a little short here in texas, but not like Michigan or Cali. the link doesn't work. The link works just fine on my PC..... Speaking of which, I noticed there are thousands and thousands of $$ being spent from the stimulus money for laptops, notebooks and pc's in some place called Round Rock, TX. Maybe you could go get you a new one? |

|

|

|

|

|

Unemployment extensions won't last forever. Then, there will be a couple new layers added to the homeless sector. On the bright side. Husseins unemployment numbers will show less folks unemployed. President Obama wanted to see the small business bill passed but the GOP wants to keep blocking it. When are you going to figure out that the GOP does NOT want to see the economy turn around?

No matter how much it hurts people that's their political strategy. How low can Rove go? Oh that reminds me, did you know that Chainy's heart quit beating? AND he's STILL alive! It lives! |

|

|

|

|

|

Edited by

InvictusV

on

Thu 08/19/10 05:55 PM

|

|

|

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. Riiiight, I mentioned the bailouts along with the stimulus because they are both deficit impacting. You can't get a loan to save your business if there are no banks to borrow from. The stimulus monies are working to stop the job losses and so far it's working. Slowly. Here are the results from the Dippic's economic reign of horror to now:

Wall Street reforms are also in the workings...hopefully we can avoid the financial corruptions that got us into trouble in the first place. http://en.wikipedia.org/wiki/US_Financial_Regulatory_Reform None of that addresses the fundamental problem. The Feds loose monetary policy after the DOTCOM bubble busting lead to a massive expansion in easy credit. It didn't help that Freddie and Fannie were making loan guarantees so banks would give mortgages to people that shouldn't have got them. Plus you had politicians pressuring banks to lower lending standards. This is a systemic problem. Until you collapse the consumption based debt driven economy, no reform or over regulation is going to change the fundamentals that brought this and the next collapse upon us. You're politcally microsizing the issue here, the FED was just ONE area in the process that led us into this mess. You are totally ignoring who the benefactors were in creating this horrible economic disaster. Big Corp. The Wall Street Reform bill, tho~ watered down like the HC Bill to appease the GOP, should be the beginning of the end of Big Corporate control of our government. Dude, got HULU? See "The Corporation" documentary. I had been screaming for years about Corporate Socialism but it's only now that people are waking up to the fact that we ARE being controlled for corporate profits over what's best for us...in ALL areas of our lives. Wall Street Reform Bill: (Wiki) "Some of the major topics it includes are creation of the Consumer Financial Protection Bureau and the Financial Stability Oversight Council, Limiting large complex financial instruments and making derivative market more transparent, many new requirements and oversight of Credit Rating Agencies, giving shareholders a say on CEO’s bonuses and many others with the main focus of strengthening economy and protecting consumer" ~~~~ Political positioning for the fall elections or are you really interested in the full story? I hope you view the documentary...it's amazing, several former CEO's testify on it...kinda long but it's a complicated issue right? It took a lot of conditions from several institutions to get us in this deep of a hole. There's no one specific smoking gun in this mess. http://www.thecorporation.com/index.cfm I get the corporate part.. the bailouts went against everything that a free market stands for. If you take risks and lose, it should have been curtains. Propping up bad businesses and doing it with taxpayer money is unacceptable. There was no reason GMAC or AIG should have been involved in mortgage backed securities. It was about unfettered greed. And they all should have paid a price. The Fed's monetary policy set the stage for the entire chain of events. Extended periods of low interest rates led to excessive leveraging and eventually collapse. With a tightening of the monetary policy after we came out of the DOTCOM recession, ie. higher interest rates, there would have never been such a boom and then bust in the housing sector. Government backed loan guarantees and pushing lowered lending standards were the final nail in the coffin. Let me ask you this.. If Fannie and Freddie weren't guaranteeing risky loans do you really think banks would have been lending so much money to people that they knew would never pay it back? |

|

|

|

|