| Topic: How is that stimulus working out? | |

|---|---|

|

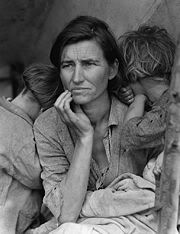

Give it time...these unemployment numbers included laid off census worker jobs. Things could be worse...and would be if the GOPers were in charge. Overall I disliked the bailouts and saw the stimulus packages as mounting debt but the alternative would have been an all out Depression. As President Obama said in his campaign it will be along road to recovery. He was not lying. So at least we've avoided another Depression...so far that is.

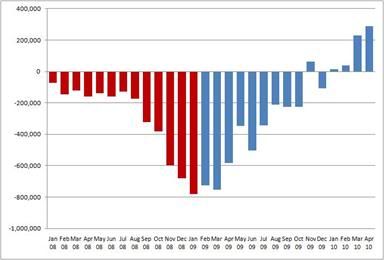

The stimulus bill did nothing to stop a depression. The Federal Reserve buying up toxic debt and clearing their banker buddies balance sheets is what kept us out of a full blown economic disaster. They had no choice since they helped create the bubble in the first place. Riiiight, I mentioned the bailouts along with the stimulus because they are both deficit impacting. You can't get a loan to save your business if there are no banks to borrow from. The stimulus monies are working to stop the job losses and so far it's working. Slowly. Here are the results from the Dippic's economic reign of horror to now:

Wall Street reforms are also in the workings...hopefully we can avoid the financial corruptions that got us into trouble in the first place. http://en.wikipedia.org/wiki/US_Financial_Regulatory_Reform None of that addresses the fundamental problem. The Feds loose monetary policy after the DOTCOM bubble busting lead to a massive expansion in easy credit. It didn't help that Freddie and Fannie were making loan guarantees so banks would give mortgages to people that shouldn't have got them. Plus you had politicians pressuring banks to lower lending standards. This is a systemic problem. Until you collapse the consumption based debt driven economy, no reform or over regulation is going to change the fundamentals that brought this and the next collapse upon us. You're politcally microsizing the issue here, the FED was just ONE area in the process that led us into this mess. You are totally ignoring who the benefactors were in creating this horrible economic disaster. Big Corp. The Wall Street Reform bill, tho~ watered down like the HC Bill to appease the GOP, should be the beginning of the end of Big Corporate control of our government. Dude, got HULU? See "The Corporation" documentary. I had been screaming for years about Corporate Socialism but it's only now that people are waking up to the fact that we ARE being controlled for corporate profits over what's best for us...in ALL areas of our lives. Wall Street Reform Bill: (Wiki) "Some of the major topics it includes are creation of the Consumer Financial Protection Bureau and the Financial Stability Oversight Council, Limiting large complex financial instruments and making derivative market more transparent, many new requirements and oversight of Credit Rating Agencies, giving shareholders a say on CEO’s bonuses and many others with the main focus of strengthening economy and protecting consumer" ~~~~ Political positioning for the fall elections or are you really interested in the full story? I hope you view the documentary...it's amazing, several former CEO's testify on it...kinda long but it's a complicated issue right? It took a lot of conditions from several institutions to get us in this deep of a hole. There's no one specific smoking gun in this mess. http://www.thecorporation.com/index.cfm I get the corporate part.. the bailouts went against everything that a free market stands for. If you take risks and lose, it should have been curtains. Propping up bad businesses and doing it with taxpayer money is unacceptable. There was no reason GMAC or AIG should have been involved in mortgage backed securities. It was about unfettered and greed. And they all should have paid a price. The Fed's monetary policy set the stage for the entire chain of events. Extended periods of low interest rates led to excessive leveraging and eventually collapse. With a tightening of the monetary policy after we came out of the DOTCOM recession, ie. higher interest rates, there would have never been such a boom and then bust in the housing sector. Government backed loan guarantees and pushing lowered lending standards were the final nail in the coffin. Let me ask you this.. If Fannie and Freddie weren't guaranteeing risky loans do you really think banks would have been lending so much money to people that they knew would never pay it back? See the documentary and get back with me. |

|

|

|

|